Lehman Brothers

Assets upon filing: $691 billion

Date of filing: Sept. 15, 2008

Description: Investment bank

What happened next: Within days of its filing, Lehman’s North American business was taken over by UK bank Barclays; Japan’s Nomura Holdings snagged its international operations.

Washington Mutual

Assets upon filing: $328 billion

Date of filing: Sept. 26, 2008

Description: Commercial bank

What happened next: In early 2009 WaMu sued the Federal Deposit Insurance Corp., which had seized its assets in late 2008. The defunct firm said the feds agreed to an overly low price ($1.9 billion) when they sold its banking business to JPMorgan Chase.

WorldCom

Assets upon filing: $104 billion

Date of filing: July 21, 2002

Description: Telecommunications provider

What happened next: In April 2004 WorldCom emerged from bankruptcy as MCI, with which it had previously merged. Verizon bought the company in February 2005. Former Chief Executive Bernard Ebbers serving 25 years for fraud.

General Motors

Assets upon filing: $91 billion

Date of filing: June 1, 2009

Description: Auto manufacturer

What happened next: GM exited bankruptcy in just over a month, thanks to a $50 billion-plus infusion from U.S. taxpayers. Pontiac and Saturn brands to be discontinued; Hummer expected to be sold to a Chinese manufacturer.

CIT Group

Assets upon filing: $80.45 billion

Date of filing: Nov. 1, 2009

Description: Corporate lender

What happened next: Another quick turnaround: CIT emerged from Chapter 11 after 38 days. Its bankruptcy cost taxpayers the $2.3 billion the government had lent the firm while it had been fighting for survival.

Enron

Assets upon filing: $66 billion

Date of filing: Dec. 2, 2001

Description: Energy trader

What happened next: Emerged from bankruptcy in 2004 and sold divisions over the course of the next couple years. Its top three pre-bankruptcy executives were found guilty of fraud-related charges.

Conseco

Assets upon filing: $61 billion

Date of filing: Dec. 18, 2002

Description: Insurance

What happened next: Three years after Conseco emerged from bankruptcy in September 2003, the Securities and Exchange Commission fined two former finance execs roughly $100,000 each for roles in earlier book-cooking. Hit hard by the recent recession, stock down 37% since September 2008.

Chrysler

Assets upon filing: $39 billion

Date of filing: April 30, 2009

Description: Auto manufacturer

What happened next: Emerged from Chapter 11 in June 2009. A 55% stake given to United Auto Workers’ retiree health care fund; Italy’s Fiat gained 20% stake that’s expected to grow. Fiat boss Sergio Marchionne now running Chrysler.

Thornburg Mortgage

Assets upon filing: $37 billion

Date of filing: May 1, 2009

Description: Mortgage Lending

What happened next: Announced upon filing for bankruptcy that it would cease operations. Founder Garrett Thornburg focused on separate investment management firm.

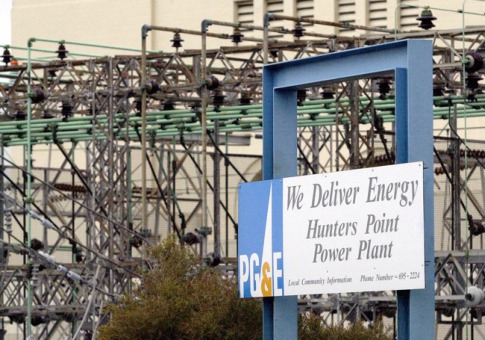

Pacific Gas & Electric

Assets upon filing: $31 billion

Date of filing: April 6, 2001

Description: Power utility (Central and Northern California)

What happened next: In June 2003 a bankruptcy judge agreed to keep PG&E under authority of California regulators instead of transferring to federal control. Californians continue to kvetch about exorbitant energy rates.

We want our community to be a useful resource for our users but it is important to remember that the community is not moderated or reviewed by doctors and so you should not rely on opinions or advice given by other users in respect of any healthcare matters.

Always speak to your doctor before acting and in cases of emergency seek appropriate medical assistance immediately. Use of our community is subject to our Terms of Use and Privacy Policy and steps will be taken to remove posts identified as being in breach of those terms.